Updates

Home / Updates

National Green Tribunal (NGT): The Tribunal is tasked with providing effective and expeditious remedy in cases relating toenvironmental protection, conservation of forests and other natural resources and enforcement of any legal right relating to environment. Act establishing the Tribunal: The National Green Tribunal Act, 2010Appellate Court: Supreme Court.

Armed Forces Tribunal (AFT): The trial or adjudication by the Armed Forces Tribunal of complaints and disputes with respect to service matters, related to the individuals subjected to the Army Act, 1950, the Air Force Act 1950, the Navy Act, 1957. The matters include- commission, enrollment, appointment, confirmation, probation, seniority,

Appellate Tribunal for Electricity (ATR): Any person aggrieved by a final order made under section 126 may, within thirty days of the said order, prefer an appeal in such form, verified in such manner and be accompanied by such fee as may be specified by the State Commission, to an

National Consumer Disputes Redressal Commission (NCDRC):The National Commission is empowered to issue instructions regarding (1) adoption of uniform procedure in the hearing of the matters, (2) prior service of copies of documents produced by one party to the opposite parties, (3) speedy grant of copies of documents, and(4) generally over-seeing

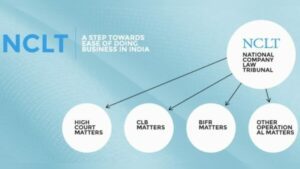

National Company Law Appellate Tribunal (NCLAT): The Appellate Tribunal has the power to control its procedure, and the Code of Civil Procedure Code doesn’t deride the course of conduct followed by the Tribunal of the Tribunal is bound by the principles of natural justice, subject to the another provisions of

Telecom Disputes Settlement and Appellate Tribunal (TDSAT):It was established to adjudicate disputes and dispose of appeals with a view to protect the interests of service providers and consumers of the telecom sector and to promote and ensureorderly growth of the telecom sector.Act establishing the Tribunal: The Telecom Regulatory Authority of

Debts Recovery Appellate Tribunal (DRAT): The main objective and role of DRT is the recovery of funds from borrowers which is payable to banks and financial institutions. The Tribunals power is limited to settle cases regarding the restoration of the unpaid amount from NPAs as declared by the banks under

Securities Appellate Tribunal (SAT): Enforce and summon the attendance of any person, require the discovery and production of documents, Receive evidence on affidavits, Issue commissions for the examination of the documents or witnesses, Dismiss an application for default or deciding it ex-parte. Act establishing the Tribunal: The Securities Exchange Board

RCT Lawyers in Chennai Law Forum. Railway Claims Tribunal (RCT): The administration of the Railways is not limited only to the running of the Railway, it is something beyond that. The functioning of the Railways also includes issues like the loss or damage to the goods of passengers traveling in